- Survey shows that young people see insufficient financial skills as a cause of their debt.

- EOS supports programs that foster financial skills.

- The company’s non-profit finlit foundation develops activities for school students across Europe.

How do you work out a budget for personal expenditures? How do I manage my finances to deal with inflation? What risks are there in mobile banking? These are the kinds of questions that consumers face, and anyone who cannot provide competent answers runs the risk of losing track of their finances. Particularly if this happens in younger years, it can trigger a pattern that in a worst-case scenario ends in excessive debt.

EOS aims to do its part to prevent such developments, which is why the company is committed to teaching young consumers about how to handle money properly. Especially children and adolescents, as they are the consumers of the future.

Embedding financial education into the school curriculum

The 2023 EOS survey “Europeans in financial trouble?” shows that there is a corresponding demand in this group in particular. More than half of young people (51%) want more financial education. Another result reveals that a total 8 percent of respondents between the ages of 18 and 34 see a lack of knowledge about banks and loans as the cause of their debt. This is why numerous EOS Group activities focus on this particular aspect.

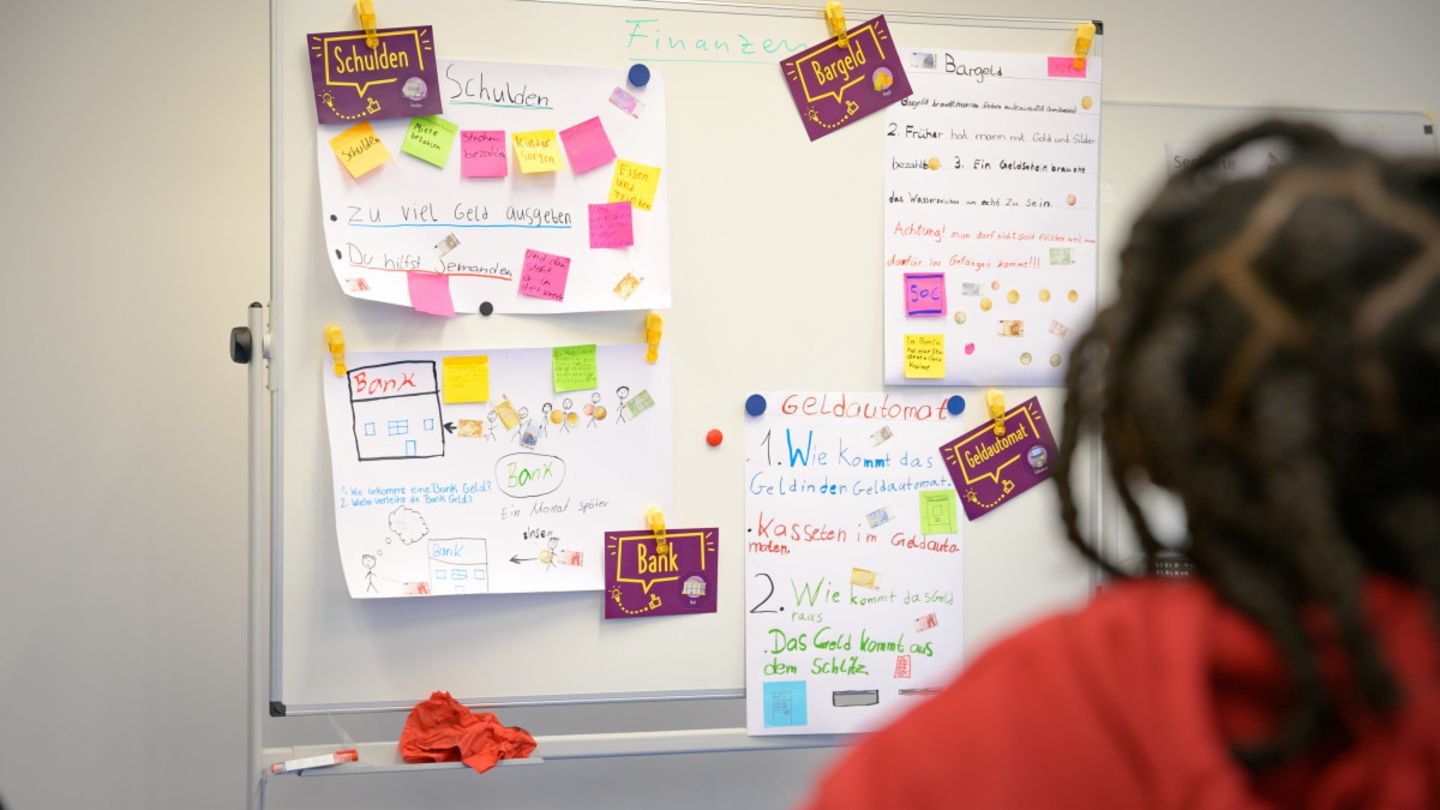

At the forefront of these activities is the finlit foundation, which was established in 2019 by EOS employees to strengthen the capabilities of young people in handling money. Through its educational initiative “ManoMoneta”, finlit has already been able to improve the financial skills and overcome the apprehension of children aged between 9 and 13 in around 1,400 schools. In fiscal 2022/23 alone, more than 32,000 children received instruction in this area.

finlit foundation imparts financial knowledge across Europe

The international rollout of finlit is now starting. Following initial pilot runs with around 140 school students in four classes and very positive feedback, ManoMoneta launched this year in Slovenia. In the Czech Republic, the program is also being extended to schools for children with special needs. And in Spain and Slovakia, school students are set to learn more about the proper handling of money from fall 2023.

Since July 2022, finlit has had additional backing from an advisory committee with representatives from the fields of business, science and social affairs, who provide advice and support with complex issues:

- Patrick Dewayne, journalist and financial expert

- Lena Lüttjens-Schilling, CEO Nordlicht Management Consultants

- Tobias Wollermann, Vice President Corporate Responsibility at Otto Group

- Professor Carmela Aprea, Director of the Institute for Financial Education (MIFE) at the University of Mannheim

- Karel Smerak, NPL Director, EOS

- Stephanie Schacke, teacher and Head of Middle School

“OhMoney” extends the target group to include teenagers

In partnership with Hanseatic Bank, finlit launched the “OhMoney” program in the 2022/23 financial year. In terms of age group, it picks up where “ManoManeta” stops, targeting students aged between 13 and 17. Interactive videos form the core of the initiative and are used for knowledge transfer. The topics are then embedded in the classroom in wide-ranging instruction modules that prepare young people for their impending financial independence. The content includes, for example, a look at their first earning opportunities, or their first holiday without parents, including issues like budgeting, contracts and insurance. In practical exercises, the students can put what they have learned into practice, e.g., by planning a class excursion. “OhMoney” has already successfully completed a test run with several classes.

In addition, EOS supports a range of financial literacy programs in several other countries. For example, since 2019, EOS Slovenia has been supporting the “Financial School”, which teaches teenagers, millennials and adults about finances. In Romania, EOS staff are explaining the basic principles of the financial world to children from Rădăuți. And EOS Croatia is sponsoring the country’s “1st Annual Financial Literacy Conference” – e.g., by providing a web page on the topics of financial education and freedom from debt.

Photo credits: EOS